PGDAU Notice nº 11/2025 sets advantageous conditions for settling debts with the Federal Union

The Procuradoria Geral da Fazenda Nacional (“PGFN”) has published PGDAU Notice nº 11/2025, effective from May 30, 2025, introducing new transaction modalities for regularizing debts registered within the Federal Union's active debt list, whether tax-related or not. These modalities offer benefits such as interest, fine, and legal fee reductions, easier upfront payments, and extended deadlines for installments.

This measure aims to encourage defaulters to regularize their fiscal standing, taking into account their payment capacity and the classification of their debts. Applications must be submitted exclusively via the REGULARIZE platform (www.regularize.pgfn.gov.br) between June 2 and September 30, 2025, from 8:00 a.m. to 7:00 p.m. (Brasília time).

Eligible debts and transaction modalities

Tax and non-tax debts registered in the Union's active debt system are eligible for inclusion, provided the consolidated amount does not exceed R$45 million per taxpayer. The registration date of the debt determines the applicable transaction modality.

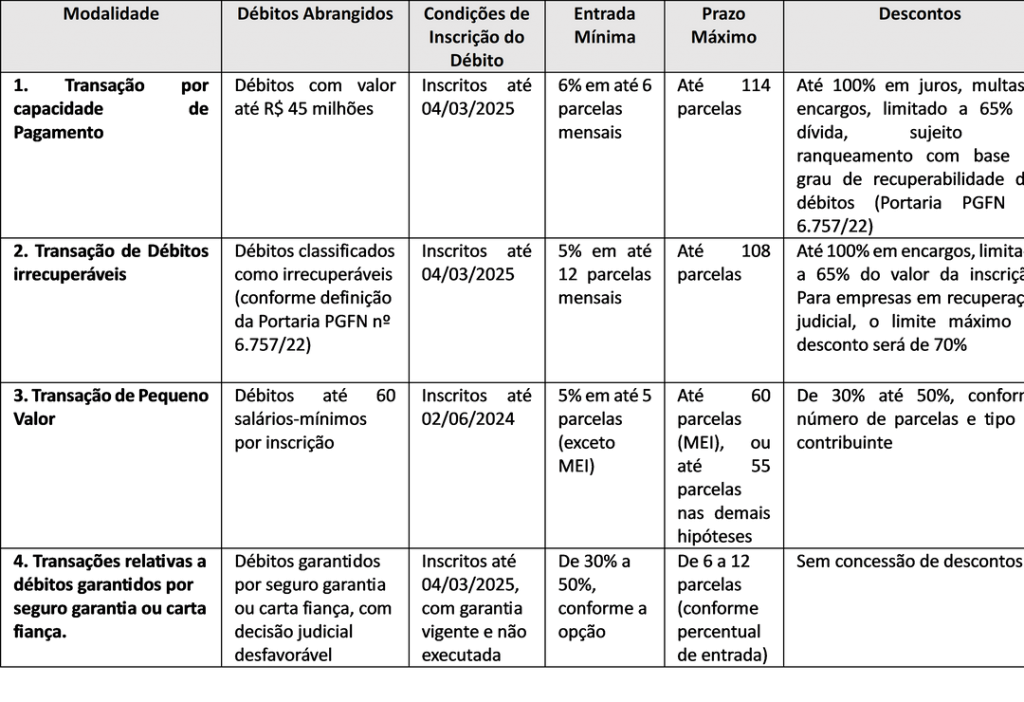

Debts registered by 03/04/2025 may qualify for the following modalities:

- Payment capacity transactions;

- Transactions for uncollectible debts;

- Transactions for debts guaranteed by insurance or a guarantee letter.

Debts registered by 06/02/2024 are exclusively eligible for:

- Small-value transactions (up to 60 minimum wages per registration).

The proposals are divided into four main modalities: 1) Payment capacity transactions, 2) Transactions for uncollectible debts, 3) Small-value debt transactions, 4) Transactions for debts guaranteed by insurance or a guarantee letter, as specified in the notice.

| Debts already subject to payment arrangements (installments, previous transactions, guarantees, or legally suspended by court rulings) may be included, provided there is a formal renunciation, as per the deadlines and conditions outlined in the notice. Taxpayers who have had previous transactions rescinded within the past two years, even for different debts, are not eligible for this initiative. |

Additional rules and restrictions

Adherence must cover all eligible debts under the contributor's name; partial adherence is not allowed.

For debts under judicial litigation, proof of renunciation of legal actions must be provided within 60 days after adherence.

Failure to pay three installments, whether consecutive or not, will result in automatic termination of the agreement.

The minimum installment amount is R$100, except for individual micro-entrepreneurs (MEI), where it is R$25.

Installments will be adjusted according to the monthly accumulated SELIC rate, with an additional 1% applied during the payment month. The contributor must maintain fiscal compliance with Receita Federal and FGTS throughout the agreement's duration.

Judicial deposits tied to the included debts will be automatically converted into final payments, with discounts applied only to the remaining balance.

Recommendation

The transaction opportunity provided under PGDAU Notice nº 11/2025 represents a strategic option for federal debt regularization, especially for taxpayers with long-standing liabilities, limited payment capacity, or low-value debts. Given the specificities of each modality and their applicable rules, performing an individualized analysis is crucial before adhering.

Our firm is available to provide comprehensive support, including eligibility verification, detailed simulations of payments and discounts, formal adherence procedures, renunciation of legal actions, and full compliance monitoring until the agreement is successfully concluded.

We remain available for any additional clarifications.

GTLawyers – Tax Team